Construction, Lending, and Demographic Data Point to Continued Weakness

Economic news for home builders.

The latest industry indicators show that although single-family housing starts are rising slowly, home construction activity remains below pre-Great Recession levels. Fewer people are claiming mortgage deductions, suggesting that home-buying activity is still subpar, according to Elliot F. Eisenberg, Ph.D., former economist for the Homebuilder Association. He notes that many young people are living with their parents, further depressing the demand for new construction. Here are his statistics in detail:

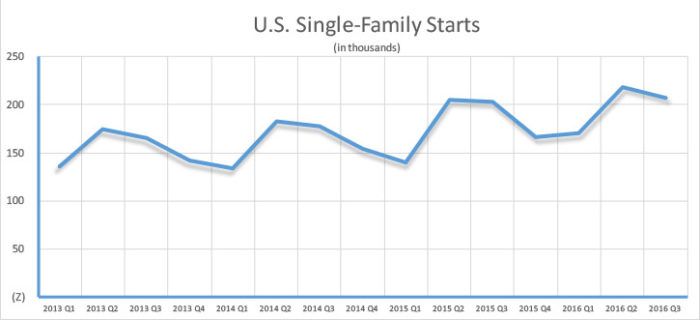

Single Starts

In 2015, single-family starts totaled 713,000 and in 2016, 783,000, up 9.8%. Remaining housing starts fell from 395,000 to 385,000. Overall, starts rose from 1.108 million to 1.168 million. Multifamily has recovered, but single-family starts remain at recessionary lows 7.5 years into a recovery! Worse, labor and lots are in short supply and home prices and rates continue rising. Given these headwinds, single-family activity rises at most 8% in 2017.

Mortgage Money

After peaking at 40.8 million in 2007, the number of tax returns claiming the mortgage interest deduction has steadily fallen, and as of 2013, the latest year from which data is available, stands at just 33.3 million. Not surprisingly, the amount of mortgage interest paid also peaked in 2007 at $491 billion and is now $296 billion, while the average amount of MID claimed/filer has fallen from $12,052 to $8,900.

Parental Palace

In 2015, the percentage of those 18 to 34 living with their parents was 39.5%, the highest level since 1940 when it was 40.9%. Of course, 1940 was one year removed from the end of the Depression. The rate then fell to an all-time low of 24.1% in 1960 and has slowly risen since with a recent big run-up. The rise is probably due to rising rents and limited credit.

FHB chart created with U.S. Commerce Dept. data. on quarterly single-family housing starts.

Fine Homebuilding Recommended Products

Anchor Bolt Marker

Plate Level

100-ft. Tape Measure

View Comments

Is it possible that the aspect of limited credit could be preventing another housing bubble collapse like the one in 2008? I'm not saying that I wouldn't like to see home building go on the rise. It's good for my wallet if it does, but I don't want to see another screeching halt like the last time everything fell apart too many friends lost way too much.